Trend Trading Like An Architect

Do you have strong analytical and problem-solving skills, an attention to detail, and can visualize complex scenarios? You may be a great architect but can also become a great trend trader.

With more than a decade of experience, I share how I became consistently profitable with trend trading. I grew sick and tired of trading books and trading courses. None turned me profitable. All of them claimed to reveal exact tactics but either remained completely vague, or scalped arbitrary candlestick patterns for little profit.

Here you’ll learn how the big money is made. I treat you like a real person who wants to succeed in trend trading. It took me a long time to get where I am today, but with the mindset and strategies I share, you can grow your trading account in a matter of months.

Why Trend Trading

Trend trading is a wonderful business. There is no inventory to store in warehouses, nothing to ship, no customers to deal with, no marketing activities to plan. You don’t have to launch a startup and hustle your way through product-market-fit. You don’t have to fly around the world attending exhibitions or send out cold emails to secure new business.

Unlike real estate, trend traders don’t have to bother with reparations or tenants who can’t pay rent. There is no staff to recruit, and no litigations to deal with. Heck, you don’t need to deal with people at all.

There’s no hyperactive day-trading involved in trend trading. You let the market do all the heavy work instead of sweating it out yourself day after day. Monitor your positions once in a while and enjoy the rest of your time.

Trend trading can be done on the side because it focuses on big trends that last weeks to months. It eventually allows you to leave the workforce and retire early, like I did at 35.

All you really need to start trading is a good amount of starting capital, a good chair, broadband internet connection, and a proper screen.

What I Learned From My Mentor

I started trend trading in November 2007 after I stumbled upon an online forum post. That’s where I met Tony, my trading mentor. This is what he messaged me when I asked if he could share links on how to read price action:

“I learned from observing price, observing how it moves, the speed at which it moves. It tells us a lot about any market. I made printouts of market data and studied it to understand why the market moved the way it did. Another thing that is very common of traders that consistently take a pounding is that they don’t understand the underlying current on why markets are moving. What is not sensible is to visit a website or read a book and expect to learn how to read price instantly.”

He was trading equity index futures at that time. 3 contracts of the E-mini Dow (YM), nothing else. He inspired me to focus on one market and trade it well. He didn’t pick tops or bottoms. He didn’t trade against the trend. He couldn’t even bother whether the market is overvalued or undervalued. He simply traded its trends, going with the flow, week after week, month after month. Huge trends. Just by monitoring price action.

My mentor made me look at futures from an entirely different angle. I learned everything I could about how to read price action – all without a single indicator whatsoever. Gone were the days of scalping the market up and down. Do yourself a favor and find a trading mentor.

Most newbie traders that are very active fall apart and it’s not hard to understand why they make common trading mistakes. They don’t see the big picture. They get mesmerized by every tick and rely heavily on indicators. Obviously they start to overtrade and end the day completely exhausted. It’s all nonsense.

ES Trend Following Journal

After a couple of months of mentoring, I sharpened my trend trading system further. I went onto a journey of self-discovery to understand my behavioral biases, finished my Business Administration studies and wrote a senior thesis on “The Psychology of Financial Markets”. Trend trading became a focus topic which I studied vigorously. I found out that people are never rational due to their inherent nature.

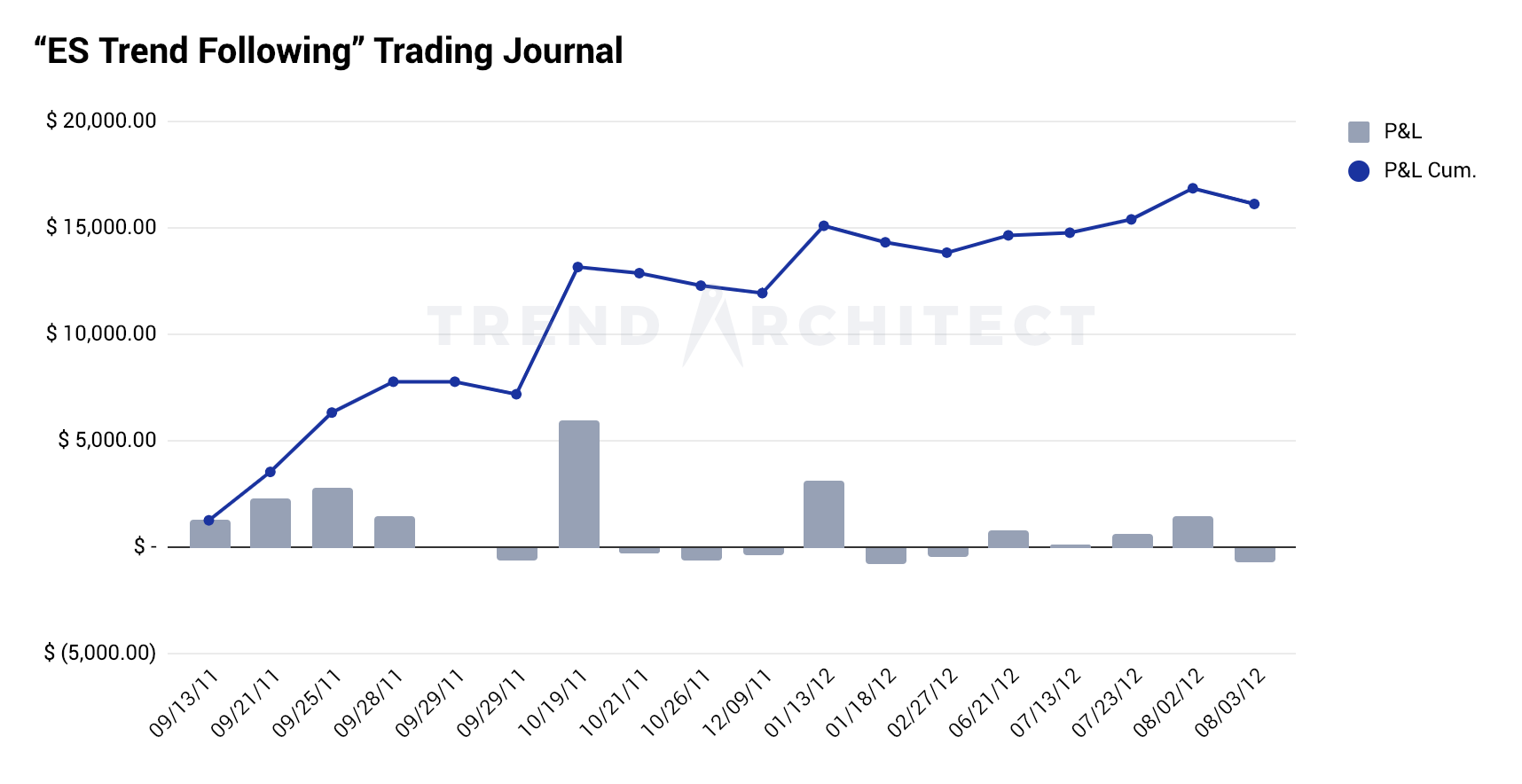

When I entered the workforce in 2011, I ran a public experiment in trend trading the E-mini S&P 500 (ES). Read through my archived trading journal “ES Trend Following” on Elite Trader in which I made $16,000 with one futures contract. It’s a case in point that you can trade profitably with a full-time job.

I elucidated all my thought processes therein and answered a lot of questions from traders. It’s impossible to fake that performance because I posted live trades as they happened.

I left the scene for several years to pursue various online businesses. With passive income streams running and therefore improved financial flexibility, I came back to futures trading full force in 2020 and have stayed on since. It’s around this time that I started sharing the methodology that you find here today.

Components of My Trend Trading System

The trend trading system I trade today is even better. It’s full-fledged with individual components working together in harmony. I refined it over many years. It tackles the root cause of market movements, not arbitrary candlestick patterns.

Parabolic Curves

One component is the modular principle of parabolic curves, named after the parabola in mathematics. Trends always take the shape of a parabolic curve. It helps us establish a bias and to trade trends in the direction of that curve. The trend is your friend, as you know.

They are backed by the Law of Inertia (also known as Newton’s First Law of Motion). You can plot anything on a timescale and observe the very trends happening in velocities or temperatures. It’s possible to profit from trends as they unfold day after day, week after week. We just have to ‘steer our ship in the direction of the prevailing wind’.

Moving Average Bounces

Another component is the moving average bounce trading strategy. Moving averages are the most popular indicator for trading trends and they act as support or resistance when the price approaches it. I frequently noticed that prices magically bottom at pre-determined levels. The price can be rejected or ‘bounced’ off at a moving average which is considered a sign of continuation of the long-term trend. I use the 10 and 20-period EMAs in combination with parabolic curves.

Get Started

All trading knowledge and tactics I share are easy to understand and easy to follow. If you’re completely new, I have 5 trend trading tips for you. Soon you’ll only buy strong markets that are moving higher and sell short weak markets that are moving lower.

The resources here are free because I make a living from futures trading. No income could incentivize me to sell you stuff which is why I rather not bother. I know how frustrating it is being a struggling trader, so I hope I can be someone you seek out for guidance.

You can email me at matt@trendarchitect.com. Before you do, please read the FAQs.