Consistent profits. Without stress.

Hi, I’m Matt Hagemann. I trade equity index futures for a living, and reinvest most of the proceeds in growth stocks. Before you ask me questions, please read the about page and FAQs to get a first impression of my trading. I want to avoid spending time or energy in answering the same questions over and over again.

Most traders have it all wrong when it comes to futures trading. I made the same mistakes any rookie makes in the beginning but eventually figured out how to trade profitably by riding big trends. It’s the most logical and most stress-free way to trade.

What’s Our Goal

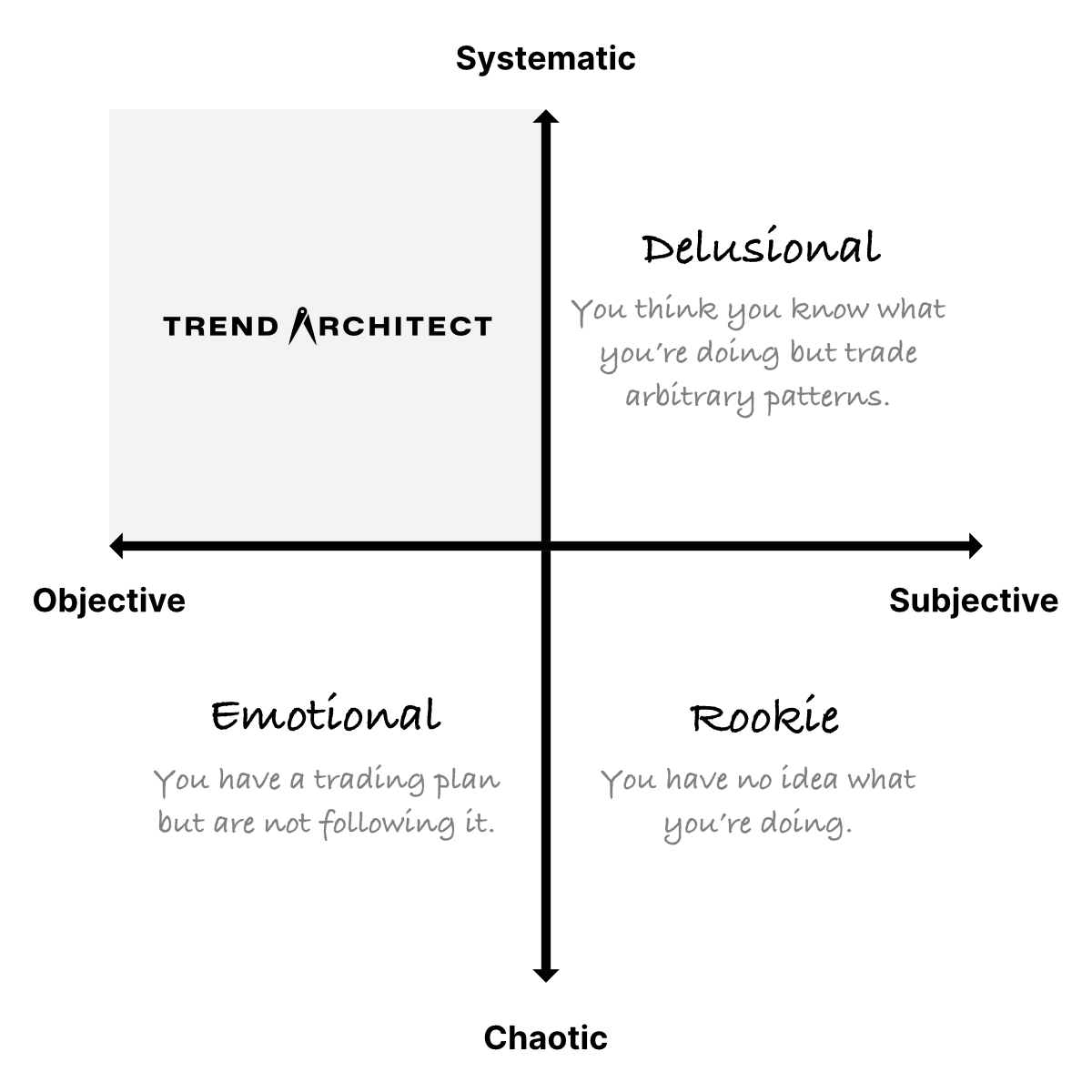

After you have read through my trading journey and sense that my style could be a good fit, I want to help you shift your trading firmly to the Trend Architect Quadrant. In this quadrant, traders excel in objective thinking and systematic execution.

- Objective Thinking.

- We want to maximize visual clarity to reinforce objective thinking. I use a charting platform with split-screen view to watch multiple timeframes of the same instrument. Nothing smaller than the 4-hour in futures (ETH), or 1-hour in stocks (RTH). We want to see what the entire market sees – not arbitrary candlestick patterns in the 5-minute.

- Systematic Execution.

- We identify an established parabolic curve and, when prices deviate off-path, look for a reversal that would push prices back into its curve. I take opportunities seriously when they emerge because the market doesn’t offer entry opportunities abundantly. Once in, I want to be sure to hold a position for as long as a move lasts. It can last weeks, sometimes months.